Vintage watches make timely investments

With the current demand for vintage watches showing no signs of letting up it’s never been a better time to look at their investment potential, says Paul Maudsley, International Specialist-Director Watches at Phillips in London.

This demand is being driven by an increasingly global audience now able to engage with specialist sales via online search engines and auction aggregators, with Phillips seeing evidence from their own sales tracked on Barnebys.

Paul took some time out to answer our questions about the current market.

Over the last decade what sort of growth have we seen in the top end of the watch market?

There has been growth across a broad spectrum of the watch market not just the top end. Each year more collectors come on board thus creating points where the values rise due to demand.

There has been growth across a broad spectrum of the watch market not just the top end. Each year more collectors come on board thus creating points where the values rise due to demand.

Which brands lead the way?

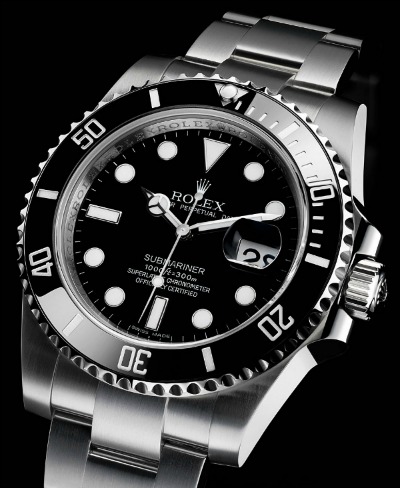

Without doubt the top two watch brands in the vintage market are Patek Philippe and Rolex. Patek Philippe was long the leader in the auctions with record after record. But then Rolex and certain vintage examples started to gain momentum and now some easily break the $500,000 and $1,000,000 mark.

What is the most collectable watch at the moment?

If you look at the two main brands and then into sub-section it would be Patek Philippe Chonographs/Moonphase and then Rolex Submariners, with all their different models/reference numbers.

Who buys what? Do different nationalities go for different things.

There’s no hard or fast rule as to what geographically location buys what type of watch anymore. It’s an entirely global audience we cater too.

Are there any new developments in this old craft?

There’s much more avant-garde watch design with contemporary watchmakers now than we have seen in its history. Using lots of unusual materials/coatings.

If so what are the most exciting?

This is a personal thing and whilst some of the very unusual watches get the headlines, the sales don’t necessarily back it up. I personally like the work of Laurent Ferrier and Kari Voutilainen.

How would you describe your top collectors?

The top collectors vary in terms of character, type of professions etc., but in terms of age the majority of the top ones fall within the 30-50 years old age group. The one main single thing that they do almost all share, is a ‘passion’ for watches.

Do they wear them or are they sitting in bank vaults?

Of all the top collectors I know most wear their watches, clearly depending on type, location. I had a coffee just the other day with a collector and he was happily wearing his Rolex that he bought through me at Phillips. It cost over £800,000.

Give us a steer on what advice you would give someone with £5,000 to spend?

If your budget was that amount I would be looking at a vintage chronograph like a Universal Tri-Compax, or an Omega Speedmaster, great heritage on each model.

How about £50,000?

I would be looking at a Patek Philippe Ref: 3970 perpetual calendar watch in either rose gold or platinum. A timeless and elegant watch.

You are able to secure some of the rarest watches. The iconic Patek Philippe Ref:1463 chronograph or the Ref:1526 with moon phase would be great trophy for the collector

Is there much difference in prices achieved at auction for men’s & women’s watches?

The market for ladies watches at auction is very small and only account for a very small percentage of our sales so it would be very hard to make a comparison.

Time is money

The last ten years have seen men’s wristwatches rocket in value says Barnebys, the art and auction aggregator which covers sales of 1,600 auction houses globally. Last year (2016) sales of vintage wristwatches at the five major international auction houses – Antiquorum, Bonhams, Christie’s, Phillips and Sotheby’s — with some 3,250 vintage and modern pieces for sale – made a total of $400m (£320,320,000).

There is no comparison between the prices being paid for men and women’s watches. Men it seems are the ones interested in this technology much more than women and are prepared to pay through the nose for the privilege of wearing the best.

The Barnebys website which displays and tracks and art and collectables auctions from auction houses around the world shows the following trends on watch searches as we enter 2017:

- Rolex is the second most searched word at Barnebys globally.

- In order of global interest in watch brands specifically: Rolex, Omega, Patek Philippe.

- Rolex has the highest amount of registered saved search alerts (in all categories) made in the UK via Barnebys, followed in order by: Omega, Cartier Patek Philippe.

Perpetual profit?

The growth in the value of top brands is well documented. Patek Philippe’s watch 3448 was the first self-winding perpetual calendar wristwatch made by Patek Philippe and was introduced into the market in 1962.

The growth in the value of top brands is well documented. Patek Philippe’s watch 3448 was the first self-winding perpetual calendar wristwatch made by Patek Philippe and was introduced into the market in 1962.

Auction prices for the Patek Philippe ref. 3448 have witnessed steady growth over the past 26 years. Since 1989, the average hammer price per 5-year period has risen consistently, from under £30,000 per lot in 1989-1995 to just over £200,000 in 2011-2015, representing an increase of over 650% or 23% per year.

Effectively, collectors who purchased a ref. 3448 at any time prior to 2006 were in a position to double their money within 10 years.

Over 80% of the turnover from Patek Philippe ref. 3448s is generated in Switzerland, and nearly 70% of all ref. 3448 lots are sold there. The average price achieved in Switzerland is considerably higher than that achieve in other salerooms. On average, there is almost no difference in price between examples sold in the USA and those sold in Hong Kong.